Office occupancy has continued to be a challenge with more supply than there is demand in Doha. The supply of office spaces in Qatar has been increasing in West Bay and Lusail, where around 170,000 people are envisioned to work in the latter.

However, the pandemic has accelerated the shift towards flexible work arrangements, therefore reducing the need for big offices. Flexible work is likely to stay in Qatar; a SESRI Policy Brief published in January 2023 revealed that 35% of surveyed employees in Qatar prefer an average of three days in the office.

Undeniably there is still a general need for companies to rent an office, and this is the case for various reasons. Firstly, a physical location is where collaboration, training, mentorship, and culture-building best happen. The same SESRI Policy Brief said that 73% of white-collar expats felt socially isolated from co-workers during the pandemic, suggesting the need to balance WFH and in-office experiences. Secondly, companies need a physical office for compliance purposes. Thirdly, having an office is a mark of credibility – in a landscape where clients are not familiar with brands, customers will avoid dealing with organizations they perceive as unreliable and unstable. Having an office is an assurance. An office in a prime building is even better.

Top Locations for Office Search

According to our Qatar’s Property Report: Q3 2023, Lusail ranked as the most popular location for tenants based on the number of search impressions, followed by Al Sadd. Movements are anticipated in Lusail as companies and institutions such as the Qatar Financial Centre Authority (6,200 sqm) relocate here.

How much are Office Lease rates in Doha?

Lusail had the highest average monthly asking lease rate per sqm at QAR 105 for shell & core and semi-fitted spaces, followed by West Bay at QAR 97, according to our Q3 2023 report. Office rents in downtown districts such as Al Sadd, Al Muntazah, Najma, and Al Hilal range between QAR 67 and QAR 80.

It is important to realize that asking lease rates differ from actual negotiated lease rates. In a tenant’s market like Doha, landlords are even more pressured to be more flexible with rents by extending offers such as significantly lower lease rates or more free months.

Is flex space the future of the office?

There is a reason why Lusail and Al Sadd are popular for office searches: The number of flex office spaces present in these areas.

Flex offices cover a wide range of corporate real estate products, from co-working space to serviced offices, all offering a plug-and-play solution. Their popularity has risen significantly since the pandemic as tenants cut costs on real estate, fit-out work, and long-term lease commitments.

Imagine the average cost of an office fit-out: According to JLL, tenants in Dubai and Riyadh would spend AED 6,665 per sqm and SAR 7,252 per sqm in 2021-2022.

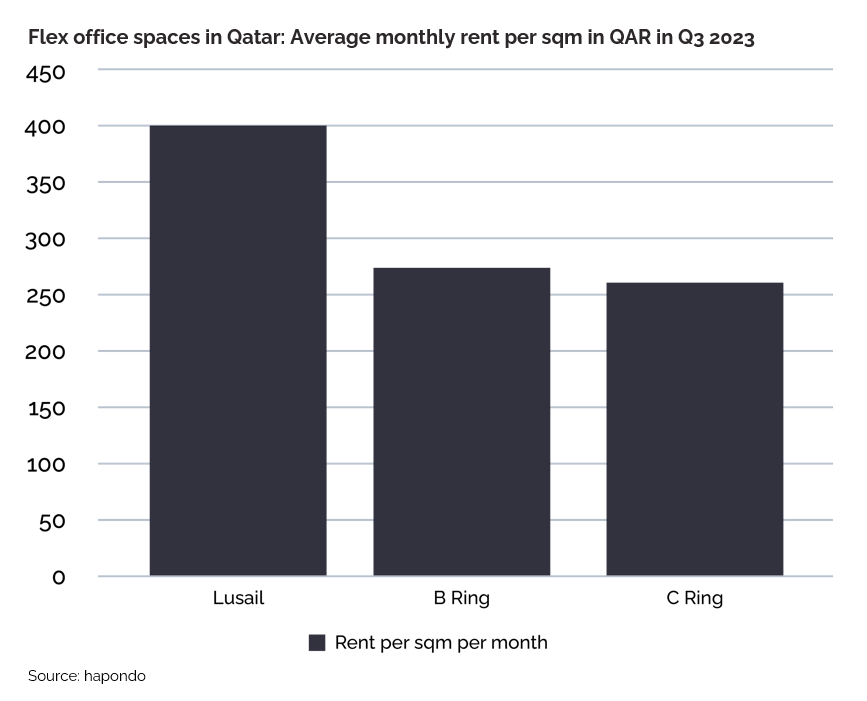

Lusail’s flex office spaces had an average monthly lease rate of QAR 405 per square meter. Flex office spaces rented for QAR 267 and QAR 279 per square meter in C-Ring and B-Ring areas in Doha in Q3 2023. Note that the pricing of flex office spaces is rarely in QAR/sqm – instead, it may be based on seats and rooms.

Tenants have therefore located in companies such as Hub Business Centre, Flare Business Centre, and Arafat Business Centre that rent out desks, furnished offices, and shared spaces with Internet, meeting room, pantry, and equipment provisions. Although the premium is two to three times the cost of renting a bare shell, these office solutions have allowed tenants to avoid long-term lease commitments and capital expenditures.

Outlook on the office market in Doha

Based on hapondo’s analysis, the office leasing sector in Qatar will remain a tenant’s market in the short to medium term. While it is true that significant transactions are happening, several of these are movements of existing companies from one district to another. In short, transactions tend to offset one district’s loss with another’s gain.

The sector’s improvement will rely on key factors, such as the growth of existing companies and the entry of new ones. Startups likely will only need small offices. It is the bigger companies, such as multinational conglomerates, that tend to take up larger spaces.

For now, smaller tenants are finding value in renting flex office spaces. They avoid significant capital expenditures in fit-out, avoid significantly long-term lease commitments, and jumpstart their operations immediately. Traditional office landlords will have to compete harder to attract tenants with better commercial terms and offers.

Download our Q3 2023 report: hapondo.qa/blog/q3-2023-qatar-property-report

Email: [email protected]

The post The Rise of Flex Office Spaces in Qatar appeared first on hapondo blog.